Altcoin Season Index: Altseason Meaning for Crypto Traders

The high liquidity and diversity of the cryptocurrency trade create numerous opportunities for making a profit. New technologies, DeFi solutions, and economic growth stimulate the appearance of new tokens. Alternative coin period is the moment when BTC loses a bit of its power, and alternative tokens become more valuable. Respectively, the Altcoin Season Index will help to catch this moment and make wise trading decisions.

Learn more about the altcoin season index, its key parameters, and where to track them in the following article.

Understanding the Altcoin Season of 90 days: What does it mean?

Cryptocurrency trading experiences fluctuations like any other valuable item on exchanges.

Many of these changes revolve around altcoins. But what is altcoin? It is an alternative to Bitcoin, a new currency in the crypto economy.

Bitcoin dominance and Altseason explanation

An “altcoin season” is a period when cryptocurrencies other than BTC gain significant value. This happens when the investors seek to increase their returns after getting big gains from BTC. As a result, the value of new tokens increases dramatically, and altcoin dominance appears.

Past altcoin seasons overview

A big Altcoin season happened in 2017. The Initial Coin Offering boom offered lots of new coins, which piqued investors’ interest. Cryptocurrencies Ethereum and Ripple have experienced dramatic value growth. At the same time, Bitcoin’s dominance dropped by almost 50%.

Another altcoin period happened in 2021. Bitcoin price reached a new peak, and after that, altcoins Binance Coin and Solana also increased in value due to the NFT boom. Tracking and analyzing market trends will help identify the next alternative coin period and benefit from it.

What is the Altcoin Season Index Chart?

The crypto economy has reacted to the cryptocurrency’s fluctuation with the “Altcoin Season Index” (ASI). Blockchain Centre has introduced this tool to monitor altcoins’ performance over BTC in a specific timeframe. It is better to learn about alt coins meaning before moving forward and diving deeper into their dynamics.

The ASI monitors the performance of the top fifty altcoins, excluding BTC and stablecoins. The time frame for such monitoring is 90 days. Alternative coin season begins when 75% or more alt coins have outperformed Bitcoin. Respectively, Bitcoin season holds if 25% or fewer altcoins show outperformance.

Traders can diversify their portfolio with cryptocurrencies if they check the cryptocurrency trends. The ASI monitoring may take time to master, but it will bring significant benefits in the long run. Binany’s altcoin season index page will help you to rotate your strategies for portfolio diversification more efficiently.

How is the Altcoin Season Index Calculated?

The Alseason Index is a measurable value that follows certain rules and prerequisites. In terms of the metrics, the following parameters play a role in the ASI evaluation:

- Top coins. The ASI considers the 50 most valuable tokens currently available in the economy. The token must be legit, liquid, and have capitalization.

- Time frame. The ASI gets updates every 90 days. This time frame reflects natural market fluctuation.

- Alternative coin value. If the returns of altcoins relative to bitcoin increase, the altcoins outperform bitcoin.

These metrics form one of three tendencies: Bitcoin, Altcoin, and Neutral markets.

25% of altcoins outperform the Bitcoin market. From 25% to 75% of altcoins’ outperformance is a neutral market. 75% and more altcoins outperforming (high index) show an alt season.

What Triggers the Next Altcoin Season?

Several factors trigger alternative coin trading. You can predict an upcoming shift in the cryptocurrency exchanges by looking at the following markers:

- Macroeconomic shifts. Cuts in interest rates, quantitative easing, and other accommodative policies motivate investors to fund high-risk assets such as altcoins.

- Bitcoin dominance declines. When Bitcoin’s market share drops, it shows that investors relocate their funds. Usually, this shift increases the value of alternative tokens.

- Liquidity increases. When global economic conditions become more favorable, the traders will have resources for investments in alternative tokens.

- Technological advancements. DeFi tech and Layer 2 solutions represent the next evolutionary step in crypto tokens. This factor also affects altcoin prices.

- Memecoins. Social resonance and the appearance of meme tokens can create a short-term altcoins season.

Binany’s market sentiment dashboard will help you monitor trends and make more strategic and well-planned decisions. Do you also want to know what is Sensex and Nifty and how to enhance your trading with them? Binany has got your back.

How to Use the Altcoin Season Index in Your Trading Strategy?

The ASI can become a valuable tool in your trading strategy diversification. If you decide to apply it and look for the right moment to enter trading, wait for the ASI value of 75. It can grow higher during the season, but 75 is the optimal number to enter the market and invest in alternative tokens.

Alternative token periods come and go. When the ASI starts to drop and falls to 50 or less, it is time to pull out. Alternative token seasons end with an ASI number of 25 or lower. Therefore, leaving while the market is still neutral and not Bitcoin-dominated is always better.

The portfolio corrections from 10% to 20% for the big tokens are an optimal metric for portfolio rebalancing. You can lock in your profits with 20% to 30% market corrections for the small tokens. Then, you can invest these profits into undervalued assets during the season.

Portfolio Rotation in the crypto market

The most optimal way to rotate your portfolio is Bitcoin-Ethereum-Alternative tokens. In this path, you can safely convert your BTC investments and put them into promising altcoins. When the season comes to an end, the reverse path is also viable.

Technical analysis can assist in the process, reducing risk factors and mitigating mistakes. Relative strength index and moving average incorporation into your diversification process will make the entry and exit boundaries more straightforward. Binany also helps combine the ASI with volume spikes and price alerts for enhanced planning.

Altcoin Season Index vs Other Market Indicators

The alt season index is a convenient tool. However, it alone does not answer all the questions. If you combine it with other metrics, you will make your predictions and decisions more precise and profitable.

Bitcoin dominance is a metric strongly connected to the ASI. It indicates how much of the trading volume BTC takes. When dominance begins to decline, it usually indicates the start of the alt coin season.

The cryptocurrency fear and greed index is also a convenient tool. When the indicator is on the “fear” mark, it is a prime opportunity to buy alternative tokens. When it reaches the “greed” level, it is a good moment to correct your portfolio.

Finally, the Total Value Locked (TVL) metric can help to predict the altseason. The higher it becomes, the more confident the traders become in altcoins. All these metrics combined will help you make grounded and beneficial trading decisions.

Risks of Trading Based on Altcoin Season Index

Despite having a dedicated tool for monitoring cryptocurrency activity, the ASI alone cannot guarantee successful investments. There are risks and pitfalls that you should be aware of.

Second, misleading signals can also show that the market is overheated. Meme tokens and hype around new crypto tokens can create a bubble that reflects overconfidence rather than real value. Finally, the alternative tokens are much more volatile than BTC and stablecoins. You will need a well-developed risk management strategy to gain profits from the alternative coins.

Where to Track the Altcoin Season Index

The alternative coins period is a popular metric. Several major platforms offer a convenient way to monitor it:

- Blockchain Centre. The original platform that introduced the ASI tool. It has a straightforward interface and delivers all the essential data: altcoins, their performance, and regular time frame updates. However, it lacks advanced analytical tools to take the monitoring to a new level.

- CoinMarketCap. This platform monitors over 100 altcoins relative to Bitcoin. It considers Bitcoin’s dominance and market cap. While it is a comprehensive and deep tool, it is not suitable for novice traders. If you wonder, “What is alt coin?” it is better to look for another platform.

- Bitget. Bitget is a multifaceted platform that provides comprehensive ASI analysis. It shows a deeper dive into the market phases and has tools for both novice and seasoned traders alike. At the same time, it lacks the depth of specialized platforms.

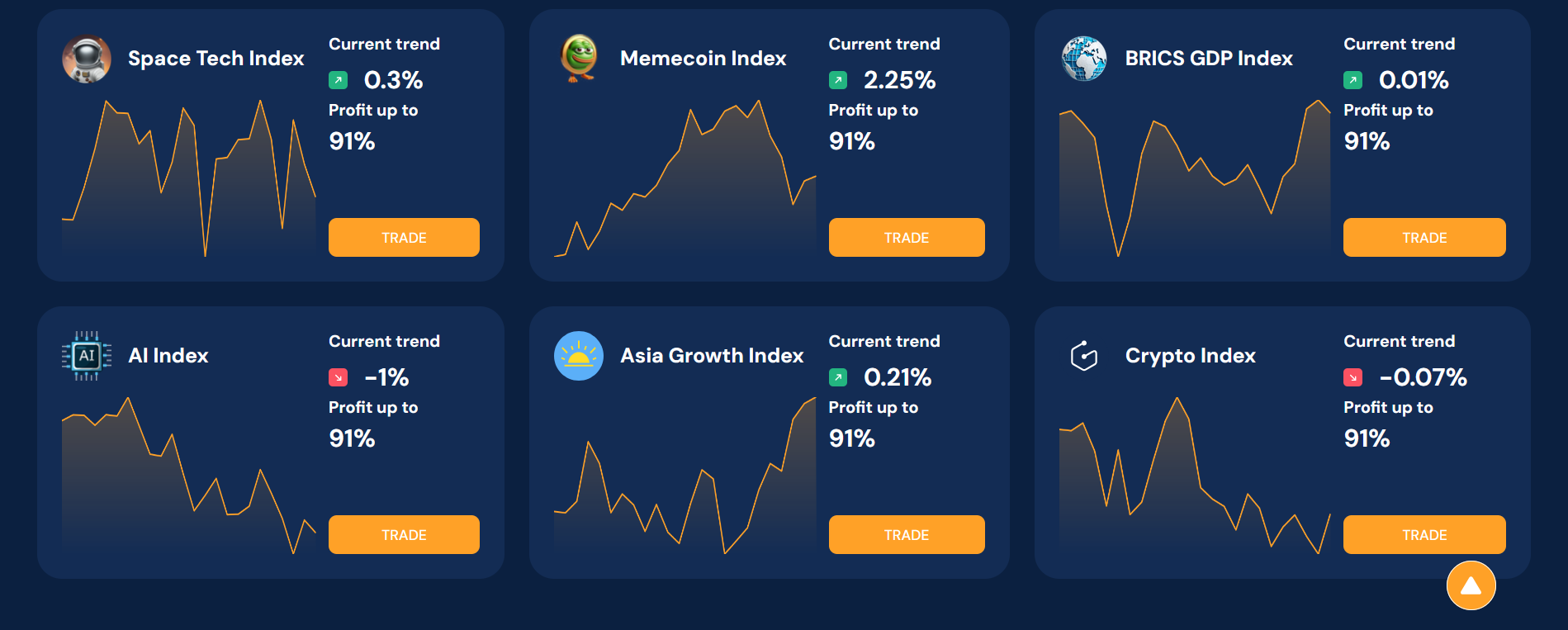

- Binany. This platform combines all the relevant ASI statistics with other economic metrics in a single, convenient dashboard. Price alerts and spike notifications make it a handy tool in building a trading strategy.

Each platform provides a unique glimpse into the ASI analysis. Each has drawbacks and limitations, too. The best way to find the platform that suits you is to experiment and find the combination of accessibility and analysis that matches your trading style.

Final Words

Alternative tokens are a potent way to diversify your portfolio. Altcoins meaning and value depend on the traders’ confidence in them. The shifting cryptocurrency market creates conditions for the Altcoin Period, when you can increase your profits. The decrease in BTC`s dominance, new technological advancements, and favourable economic conditions are key prerequisites for the appearance of the alternative tokens period.

When more than 75% of the currently viable alternative tokens outperform BTC, it is time to enter the market and rotate your portfolio. Do not forget about technical analysis and other market factors, such as the relative strength index and moving average, to mitigate the risks and increase profits.

Binany is a perfect place to track all the essential data in one place and make grounded decisions. Give it a try when you decide to catch the next alternative tokens period.

FAQ

What Is the Altіseason Index?

The altcoin index shows how many of the current top 50 altcoins outperform BTC. If more than 75% do, it signals an altseason. Understanding what altcoins are is essential to using ASI effectively.

What Are the Top 5 Altcoins Besides Bitcoin?

Top 5 altcoins currently include XRP, Solana, Ethereum, Binance Coin, and Cardano. You can convert BTC to these tokens during altseason and reinvest profits in emerging assets.

What Is the Value of 1 Token in the Alt Season and the Bitcoin Season?

Altcoin refers to all crypto tokens that aren’t BTC or stablecoins. For example, 1 ETH may be worth 152,780 INR, while SHIB might be 0.00085 INR—both are altcoins with different values.

What Is the Total 3 in Crypto?

Total 3 is a crypto index showing total market capitalization excluding BTC and ETH. Together with ASI, it supports strategy building and market analysis.

Financial writer and market analyst with a passion for simplifying complex trading concepts. He specializes in creating educational content that empowers readers to make informed investment decisions.