Gold Trading for Beginners – Step-by-Step Guide to Profitable Gold Trade

Do you think that gold is just a beautiful metal utilized in jewelry? This is a wrong opinion. Over time, it has become an important asset for investors and traders seeking financial wealth. This is a safe haven during periods of economic instability and currency fluctuations. Let's explore how to use it for investing. Here you will find everything you need to know to become a smart gold trader.

What is Gold Futures?

Gold futures allow buying or selling gold at a pre-determined price on a specific date in the future. These contracts are the most popular gold trading tools today. After all, they enable speculation on changes in prices without requiring ownership of the metal itself. So, traders and investors can benefit from price fluctuations, without the risk associated with physical purchase or sale.

Importance of Investing in Gold

Why is investing in gold so attractive? Firstly, gold traditionally retains its value in volatile financial markets and can even rise in price. When the dollar weakens, gold rises in price. And this is quite obvious. Its value is not tied to currencies and is not affected by market changes. Secondly, gold is used in various industries: jewelry, electronics, medicine, etc. This confirms its stable demand.

Besides, gold is a good investment with long-term growth prospects. It is perfect for creating a diversified portfolio because the value of this asset can balance the risks of other investments.

How to Trade in Gold: Simple Steps to Follow

Would you like to learn how to trade gold in India? In fact, everything is simple. But it’s still necessary to know the basic steps involved.

Learn the Difference Between Gold Investing and Trading

First step is to understand what is investing and what is trading in gold. Gold investing is a longer-term strategy that involves purchasing gold-related assets. But what is gold trading? Gold trading, in turn, represents short-term trades, where you can speculate on price fluctuations. Here are some types of assets to work with:

- gold bullion (physical gold in the form of coins and bars);

- spot gold (buying/selling gold at the current market price);

- gold futures (future transactions at an established price);

- gold options (give the right, but not the obligation, to buy or sell gold at a set price).

Gold traders should consider all these assets to select the best GCE gold trading strategy for maximizing profits.

Find Out What Drives the Price of Gold

Gold prices depend on many factors including supply & demand, economic conditions, investor sentiment, and more. But demand probably plays a decisive role. According to the World Gold Council, jewelry demand accounts for about 50% of total annual gold consumption, 29% comes from ETFs, and 21% – from other sources.

Gold is also considered a safe haven, i.e. a resource that investors rely on for security during periods of uncertainty. In volatile markets, gold often rises in price because its value is preserved.

How to Trade in Gold MCX – Choose Your Preferred Method

Do you have any plans regarding your gold trading business? Strategies vary depending on the goals and trading style. So, making a choice is not as easy as it may seem at first.

For trading:

- speculate on the rise or fall in gold prices;

- use leverage to increase exposure;

- take short-term positions;

- hedge your portfolio;

- trade without owning the underlying asset, etc.

For investment:

- buy/sell gold stocks and ETFs;

- focus on long-term growth;

- create a diversified portfolio;

- own the underlying asset;

- receive voting rights and dividends (if paid), etc.

Each option has its own risks and benefits, so take some time to decide.

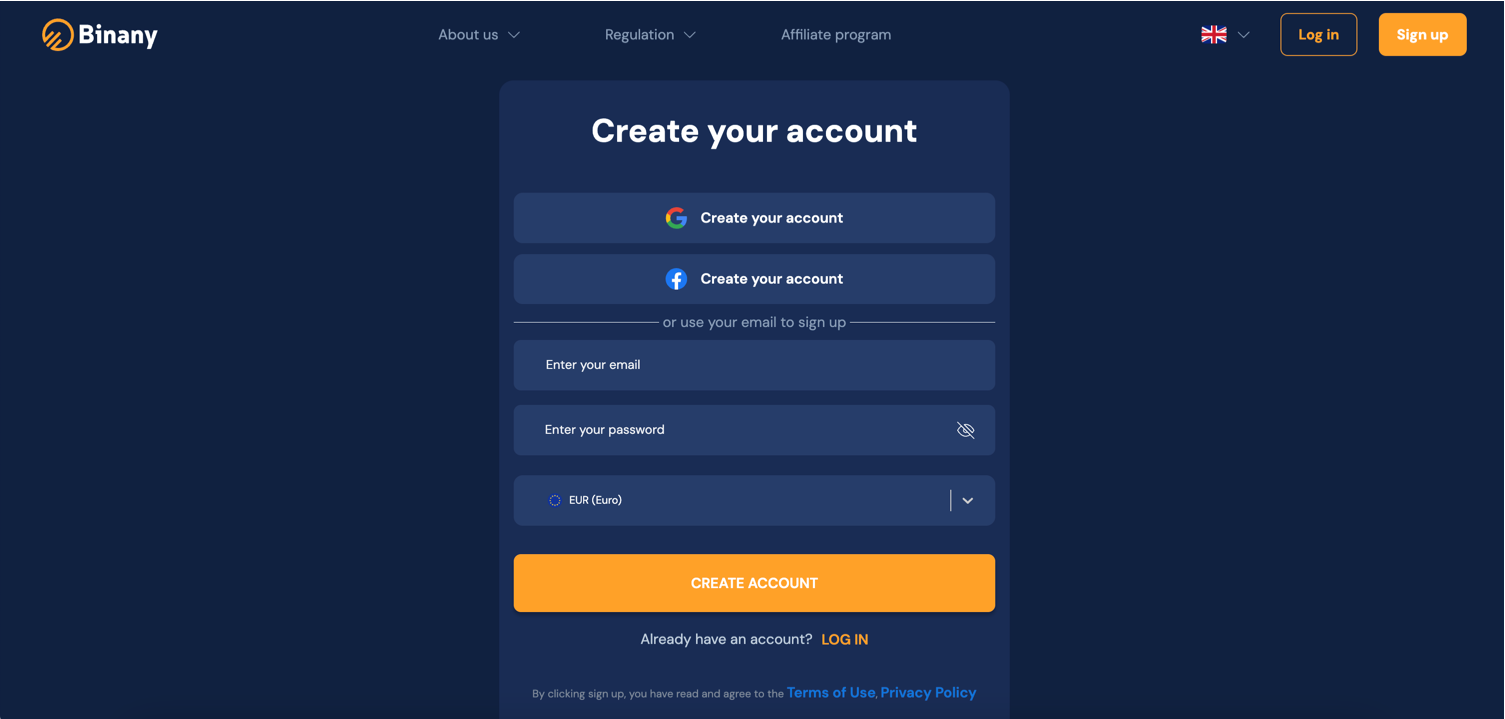

Create a Gold Trading Account

The next step is to create a personal account. Binany offers a platform where you can easily open a gold trading account and start earning cash. The registration process is straightforward and requires just a few minutes.

How to Trade in Gold in India – Find Your Gold Opportunity

Various useful resources help choose the ideal entry point for a trade:

- Expert analysis – use technical and fundamental analysis provided by experts to understand current trends and forecasts for gold market trading.

- Technical indicators – indicators such as MACD and Bollinger bands help analyze charts and predict possible price movements.

- Trading alerts – set up automatic notifications to receive information when the gold price reaches the desired level.

- Trading signals – get specific recommendations for buying and selling gold based on market signals.

Using detailed analytics and signals, gold traders effectively predict price movements and make informed decisions.

Open Your First Gold Trade

After creating an account and logging into the platform, open your first trade in gold! Try to select the appropriate tool and prepare well to reduce risks and capitalize on market opportunities.

Spot Gold

Spot trade is a market where gold is bought and sold immediately. That is, the transaction occurs in real-time at the current market price. This is one of the most popular ways to trade gold, as spot gold trades are executed quickly and give you direct exposure to physical gold (although you do not actually buy or hold it).

How does it work?

- Determine the entry point based on technical analysis or news.

- Select the transaction amount and volume.

- Hold on for a moment; your trade will be finalized soon.

Spot gold is great for those who want to make a quick profit in a short time by following short-term price fluctuations.

Gold Futures

Gold futures – a more complex and risky tool compared to spot gold. Yet they give traders the opportunity to profit from changes in gold prices over the long term.

How to do gold trading in this case? Here are the steps to follow:

- Choose the contract expiration date (month, quarter, or even year).

- Set the price at which you want to buy or sell gold.

- Wait for the contract expiration date to close the deal.

Please note that futures contracts let traders use leverage to increase potential profits. This is a big advantage.

Gold Options

Gold options give you the right, but not the obligation, to buy or sell gold at a certain price in the future. This is a great tool for traders interested in a more flexible trading strategy. Unlike futures contracts, where the contract must be executed, with options you can exit the trade if it is not profitable.

Basic steps:

- Choose the type of option (call or put) depending on whether you expect gold prices to rise or fall.

- Determine the expiration date.

- Use options as a way to hedge or speculate.

When to trade gold options? This is an excellent option for individuals looking to minimize their risks while maintaining market flexibility.

Gold Stocks and ETFs

Gold stocks and ETFs represent one more interesting option. You get indirect access to gold commodity trading, which may be less risky than trading gold directly.

Monitor the Trade and Close Your Position

Once your trade is open, you can track its results to see how profitable or unprofitable your position is. Try to check your balance regularly and make decisions based on the current market situation.

Main Benefits of Investing in Gold Futures

Investing in gold futures can be a powerful lever for your financial decisions, and here’s why:

- Liquidity and accessibility. Gold is one of the most liquid assets, which means you can easily buy or sell gold futures.

- Risk hedging option. Gold is commonly regarded as a safe haven asset that stabilizes positions in unstable times. This is especially relevant during inflation or falling exchange rates.

- Financial leverage. You can trade with borrowed funds, thereby increasing profit potential.

- Transparency and regulation. The gold futures market is strictly regulated, which adds confidence in trading fairness and protection against manipulation.

- Portfolio diversification. Gold is not correlated with most other assets such as stocks or bonds. So, it’s a great tool for balancing risk.

- Long-term value. Gold always shows stable growth, especially during periods of economic instability.

Overall, gold futures can satisfy the needs of even the most demanding market participants.

How to Trade on Gold: Some Useful Tips

Successful FY gold trading involves taking into account several factors. Pay attention to the following tips:

- Study the market dynamics – always check how the price of gold changes and what factors influence it.

- Follow economic news – news about the global economic situation can affect the price.

- Use technical indicators such as MACD to make data-driven decisions.

- Remember about diversification – so choose several interesting gold trade options.

- Keep an eye on volatility – gold often exhibits price fluctuations.

- Analyze the market – conduct a thorough market analysis before making any trades.

In conclusion, online trading gold is an exciting and potentially lucrative field that offers many opportunities for investors and traders. With the right knowledge and strategies, you can not only protect your capital but also increase it significantly.

FAQ

What are gold futures?

Gold futures are financial agreements that require parties to exchange an asset at a specified future date.

How do you trade in gold?

Trading gold takes place by purchasing or selling gold on various markets using futures, options, or other financial tools.

Is trading in gold profitable?

Yes, gold trading can be profitable but it also comes with risks. Success depends on proper market analysis and the use of effective strategies.

What is called gold trading?

Gold trading is the process of buying/selling gold assets to profit from price changes. This may include futures contracts, options, gold mining stocks, and other forms.

Is gold trading legal in India?

Yes, gold trading is legal in India but regulated by local financial authorities.

How do you trade in gold with IG?

You need to create an account, make a deposit, and choose an asset.

What moves gold markets?

The price of gold is affected by several factors, such as economic statistics, fluctuations in currency markets, inflation rates, as well as demand from the jewelry sector and investment funds.

When can I trade gold?

Gold is traded 24/7. However, market activity varies depending on the time of day and the condition of global economies.

Financial writer and market analyst with a passion for simplifying complex trading concepts. He specializes in creating educational content that empowers readers to make informed investment decisions.